Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

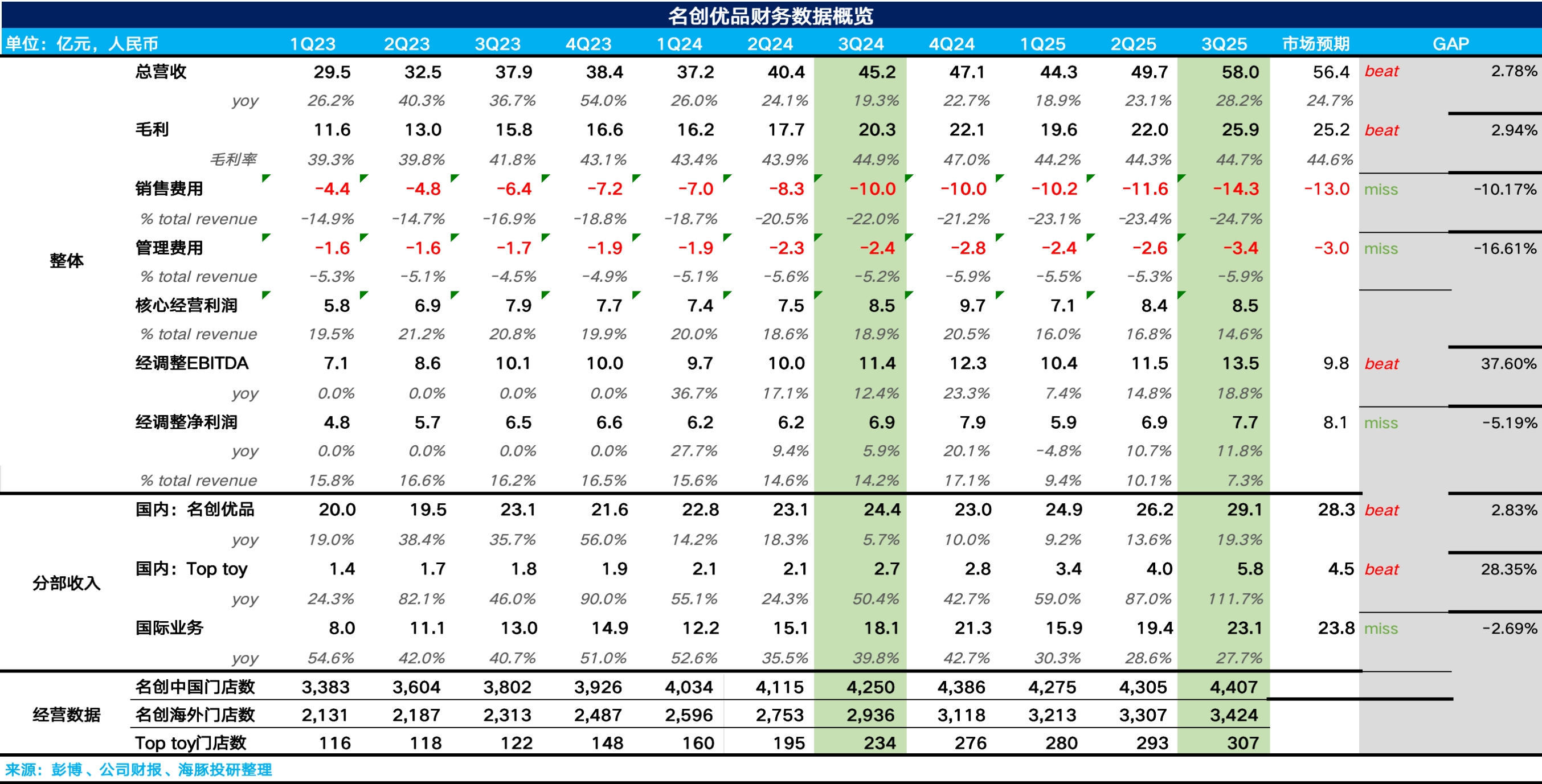

MINISO 3Q25 Quick Interpretation: Overall, MINISO's third-quarter performance was mixed. On the positive side, by closing inefficient small stores and focusing on larger stores, same-store sales growt...

1120 | Dolphin Research Focus: 🐬 Macro/Industry 1. The U.S. September non-farm payrolls are set to be released tonight. This is the first monthly employment report issued by the U.S. Bureau of Labor ...

MINISO (Minutes): Annual revenue growth rate not less than 25%, profit margin improving quarter by quarter

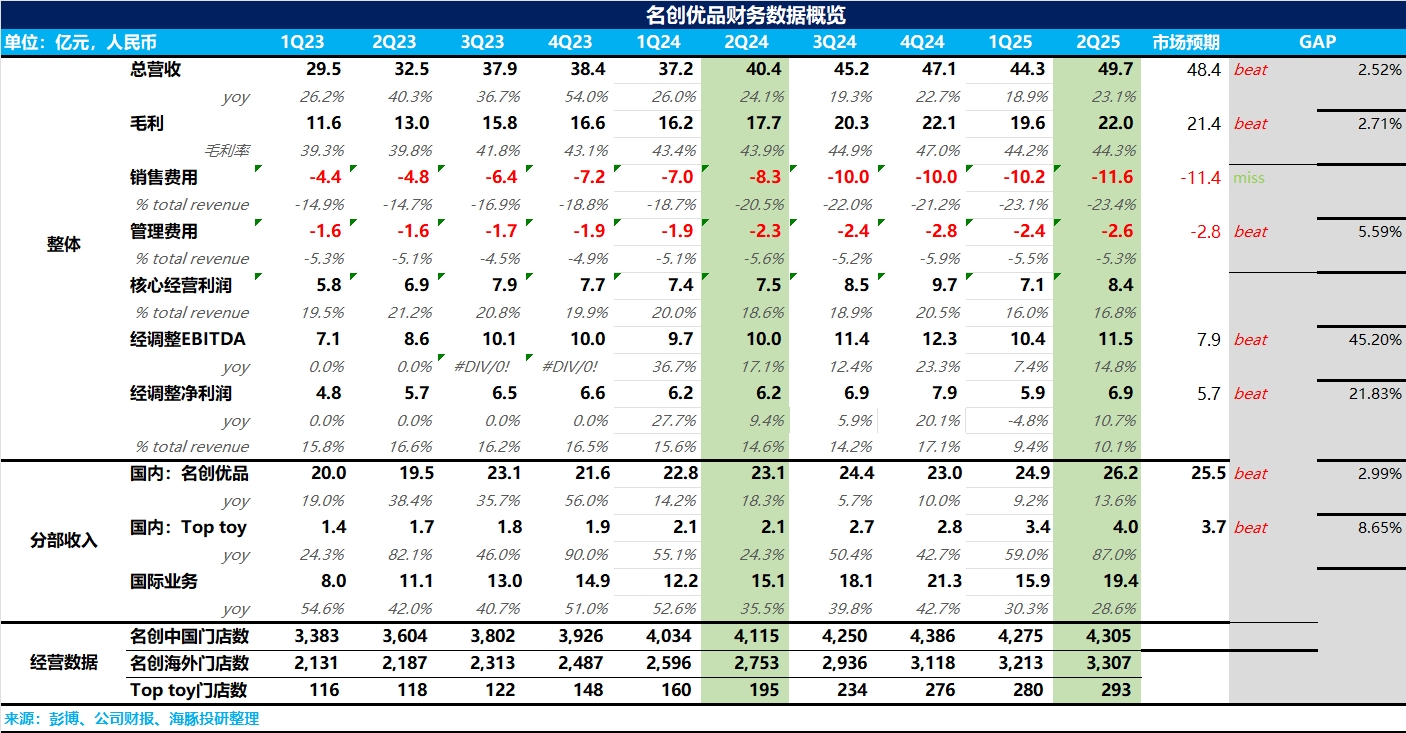

The following are the minutes of MINISO's Q2 2025 earnings call organized by Dolphin Research. For an interpretation of the financial report, please refer to "MINISO: Large Stores to the Rescue, Is IP...

On the afternoon of August 21st, Beijing time, MINISO (9896.HK) (MNSO.N) released its Q2 2025 performance report. By closing inefficient small stores and converting small stores into larger ones, the ...

MINISO 2Q25 Quick Interpretation: Overall, MINISO's second-quarter performance was quite good. By closing inefficient small stores and converting small stores into larger ones, MINISO finally achieved...