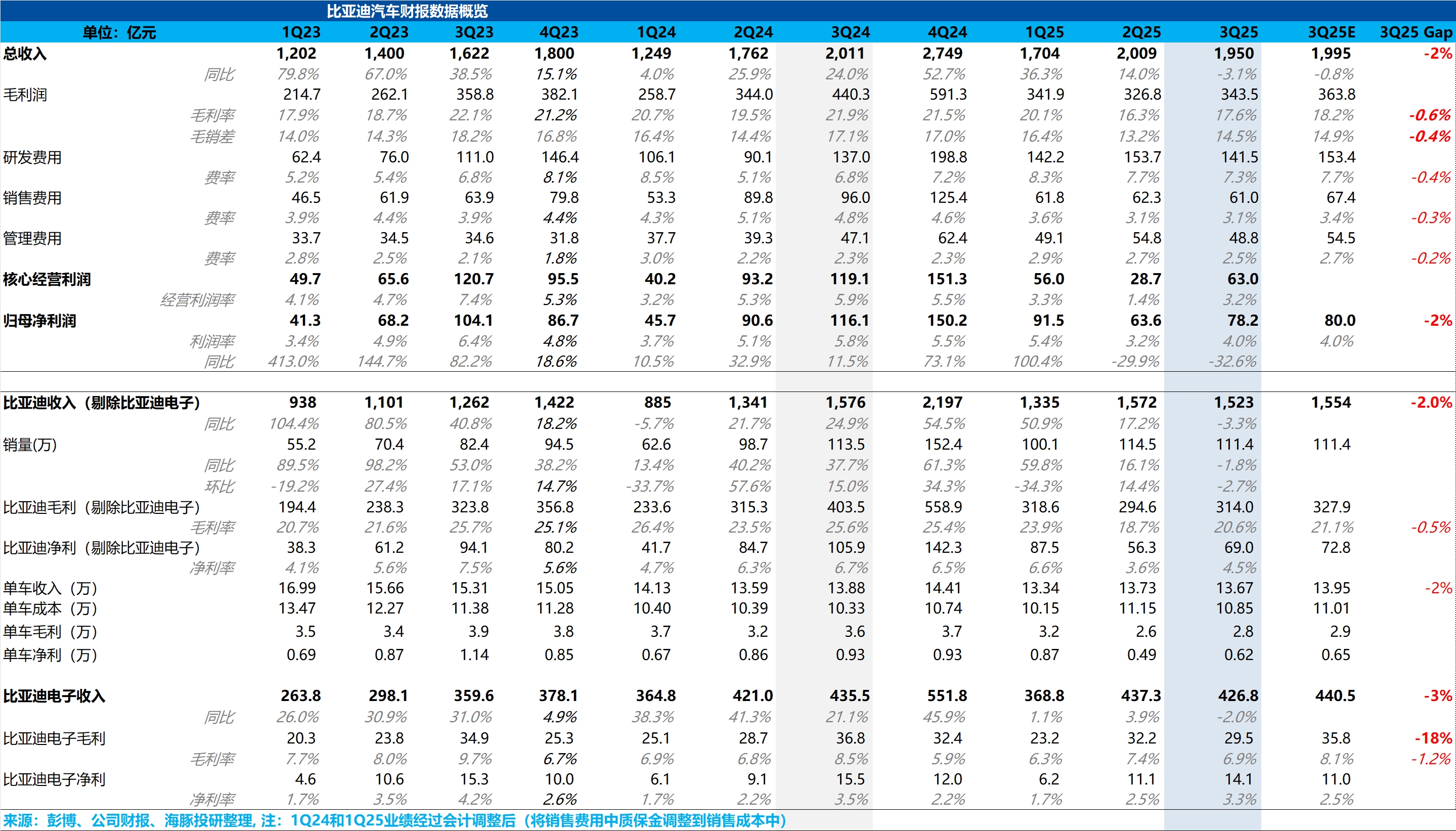

BYD Financial Report Quick Interpretation: Overall, since BYD's car sales in the third quarter continued to decline quarter-on-quarter, the market's expectations for this financial report were not high, and the actual performance of this report was slightly below market expectations.

From the perspective of car sales revenue, since the sales volume has been announced, and in the third quarter, BYD was limited by the restrictions on price wars due to anti-involution, there was a certain recovery in the discount intensity compared to the second quarter. Therefore, the market believes that the unit price of cars sold by BYD began to rise quarter-on-quarter this quarter.

However, due to the decline in the proportion of higher-priced high-end models (Yangwang, Denza, Fangchengbao) and export models in BYD's sales structure, it somewhat dragged down the unit price of cars sold.

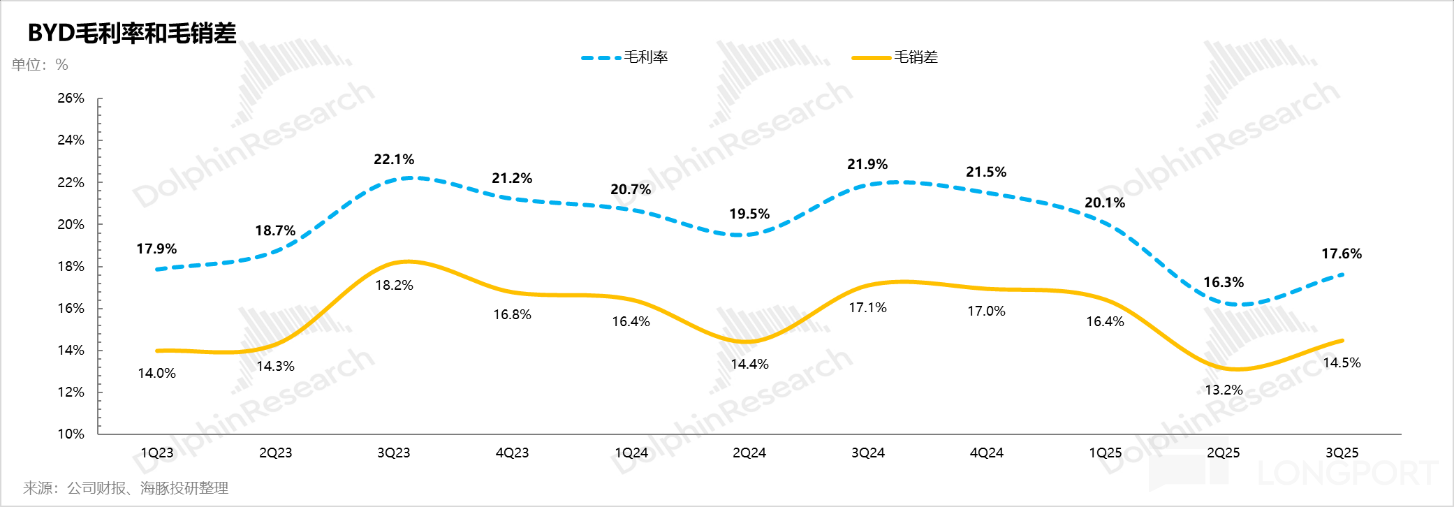

Fortunately, the gross profit margin of car sales finally emerged from the low point of the previous quarter, rising by 1.9 percentage points to 20.6% this quarter. Dolphin Research believes this is mainly due to BYD's capital expenditure pace slowing down this quarter, with fixed assets also declining quarter-on-quarter, controlling the overall amortization amount, and possibly some cost reductions in the supply chain.

This quarter, the net profit attributable to the parent company rebounded by 1.44 billion to 7.8 billion, mainly because BYD's core three expenses decreased by nearly 2 billion quarter-on-quarter. Finally, we see a trend of narrowing in BYD's massive R&D expenses, and management expenses are also starting to narrow.

Finally, the net profit per vehicle was 6,200 yuan, rebounding by 1,300 yuan from the previous quarter's low of 4,900 yuan, but still slightly below the expected 6,500 yuan.

From a valuation perspective, due to BYD's large-scale price war still being restricted by anti-involution and the 2025 "Intelligent Driving Equality" new product cycle not meeting expectations, and according to Reuters, BYD also lowered its initial target of 5.5 million vehicles to the current 4.6 million, which has led to BYD's stock price retreating by 25% from its high point in May 2025.

Dolphin Research expects that the rush-buying effect brought by the decline in purchase tax in the fourth quarter, and BYD's launch of plug-in hybrid models with larger batteries and longer ranges starting in September, will lead to a 29% quarter-on-quarter increase in sales in the fourth quarter to 1.44 million vehicles, reaching the 2025 annual sales expectation of 4.7 million vehicles. However, the corresponding P/E ratio for BYD in 2025 is still 25 times, which is not considered cheap.

Especially since Dolphin Research expects net profit in 2025 to decline by 10% year-on-year compared to 2024, and the overall new car cycle strategy for 2026 is still uncertain, with no obvious upward catalysts in sight, Dolphin Research remains relatively cautious about investing in BYD. $BYD(002594.SZ) $BYD COMPANY(01211.HK) $BYD Company Limited(BYDDF.US)