Valuation analysis

- P/E

- Price

- High

- Median

- Low

- P/B

- Price

- High

- Median

- Low

- P/S

- Price

- High

- Median

- Low

- Dividend Yield

- Price

- High

- Median

- Low

Institutional View & Shareholder

Analyst Ratings

- Price--

- Highest--

- Lowest--

$Tesla(TSLA.US) increasingly trades on AI, which makes up 60%+ of its valuation, with car sales now a sideshow—this is the core driver of its ~$1.5tn market cap. Even if 2025 full-year deliveries are ...

1120 | Dolphin Research Focus: 🐬 Macro/Industry 1. The U.S. September non-farm payrolls are set to be released tonight. This is the first monthly employment report issued by the U.S. Bureau of Labor ...

xAI is the neural core linking everything Elon touches, $Tesla(TSLA.US) Tesla, X, Optimus, Dojo. A single intelligence layer powering both the digital and physical world.

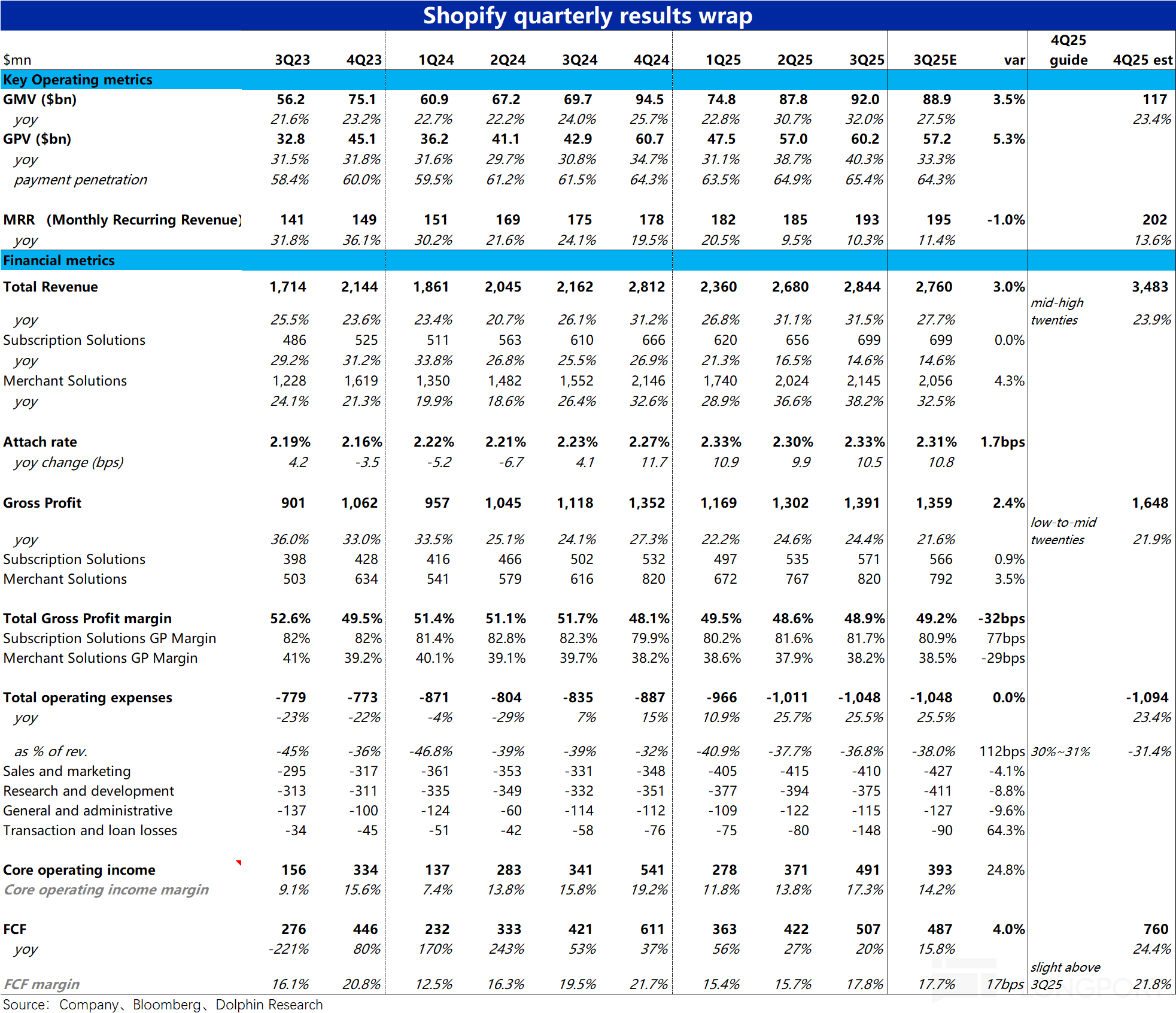

The following is the FY25Q3 earnings call minutes of $Shopify (SHOP.US) organized by Dolphin Research. For earnings interpretation, please refer to "Shopify: Is Imperfection Unacceptable, the Original...

The following are the minutes of the FY25Q3 earnings call for $Tesla(TSLA.US) organized by Dolphin Research. For earnings interpretation, please refer to "Tesla: Relying on the Stars and the Sea, It's...